BTC Price Prediction: Institutional Adoption to Drive $1M Targets by 2040

#BTC

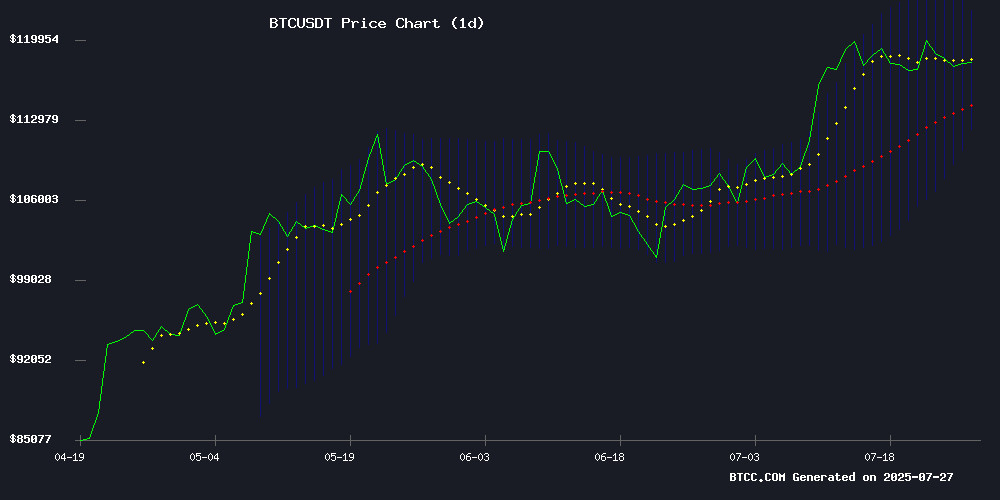

- Technical Strength: Price holding above key MAs with bullish MACD crossover

- Institutional Demand: $1T realized cap and corporate accumulation offset whale selling

- Macro Tailwinds: De-dollarization and treasury adoption creating structural demand

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

BTC is currently trading at, above its 20-day moving average (117,342.23), indicating near-term bullish momentum. The MACD histogram shows a bullish crossover at, while price hovers NEAR the upper Bollinger Band (122,560.01) – a classic sign of strength.says BTCC analyst Olivia.

Institutional Tsunami Offsets Whale Concerns: Bitcoin's $1T Milestone Fuels Bull Case

While Satoshi-era whale movements sparked temporary anxiety, the market absorbed $9B in sell pressure without breaking below $118k – demonstrating remarkable resilience.notes BTCC's Olivia. Key bullish drivers include:

- US Treasury's potential BTC reserves discussion

- 46% surge in corporate holdings

- Bitwise CIO's declaration of a new institutional cycle

Factors Influencing BTC’s Price

$9 Billion Exit by Satoshi-Era BTC Whale Sparks Debate: Are Bitcoin OGs Losing Faith?

Bitcoin's identity crisis resurfaced dramatically over the weekend as Galaxy Digital facilitated a staggering $9 billion sale of more than 80,000 BTC for a Satoshi-era investor. The transaction, framed as part of estate planning, instantly became a lightning rod for debate about early adopters' confidence in the cryptocurrency.

Crypto analyst Scott Melker ignited controversy with a pointed observation: "Bitcoin is amazing, but it's obviously been co-opted to some degree by the very people it was created to hedge against." His remarks about shaken faith among early whales sparked fierce discussions across the crypto community, with opinions divided on whether this represented ideological abandonment or prudent financial management.

The market reaction revealed deeper tensions. While some dismissed the sale as a personal financial decision unrelated to Bitcoin's fundamentals, others saw it as symptomatic of a broader existential question facing the cryptocurrency. The debate continues to reverberate through trading circles, with no clear consensus emerging about what the whale's exit truly signifies for Bitcoin's future.

Bitcoin Achieves $1 Trillion Realized Capitalization Milestone Amid Market Resilience

Bitcoin's realized capitalization has surpassed $1 trillion for the first time, marking a historic milestone in the cryptocurrency's maturation. Glassnode data confirms this metric, which calculates the cumulative value of BTC based on their last purchase price rather than current market value.

The achievement comes amid remarkable market stability, as evidenced by a Satoshi-era whale's sale of 80,000 BTC (worth approximately $9 billion) failing to disrupt Bitcoin's price. The digital asset maintained its position above $118,000 without triggering panic selling or significant volatility.

This dual demonstration of technical achievement and psychological resilience underscores Bitcoin's growing robustness in the face of major market events. The realized cap milestone coincides with increasing institutional interest, as highlighted by prominent investors like Robert Kiyosaki publicly increasing their Bitcoin allocations.

Bitcoin Price Holds Strong Above $118K Despite Recent Volatility

Bitcoin demonstrates resilience as it trades at $118,274, maintaining bullish momentum despite recent market fluctuations. The cryptocurrency recovered from a 2.43% dip on July 25, showcasing its ability to weather short-term volatility.

Regulatory tailwinds emerge as the GENIUS Act, signed into law on July 22, establishes the first comprehensive framework for stablecoins in the U.S. While the immediate price impact was muted, this legislative clarity sets the stage for institutional adoption and long-term growth.

Technical indicators paint a mixed picture with the RSI at 61.24—neutral territory suggesting room for upward movement. Bitcoin continues to navigate between key support and resistance levels, with market participants watching for the next decisive breakout.

Bitcoin Treasury Stocks Echo 1920s Speculative Mania Amid Sky-High Premiums

Bitcoin-backed 'treasury' stocks are drawing unsettling parallels to the investment-trust frenzy of the 1920s, with premiums reaching unsustainable levels. At the peak of the 2025 crypto boom, some BTC-backed equities traded at 23 times the value of their underlying bitcoin holdings—a speculative pathology mirroring the prelude to the 1929 crash.

Yale economist Irving Fisher's infamous 'permanently high plateau' declaration now finds a modern counterpart in Bitcoin maximalists like Michael Saylor, who champion treasury stocks as superior investment vehicles. The narrative of scarcity and easy money that fueled both eras raises red flags about reflexive market bubbles.

Current valuations show dangerous detachment from fundamentals, with premiums reminiscent of Goldman Sachs Trading Corp.'s 1929 peak when investors paid triple the value of underlying assets. This historical rhyme suggests crypto markets may be repeating past mistakes rather than forging new paradigms.

US Bitcoin Reserves Could Propel BTC to $1M, Fueling Institutional Adoption

Bitcoin's trajectory toward $1 million per coin gains credibility as central banks and sovereign wealth funds accumulate BTC reserves. The US government's GENIUS Act under the Trump administration marked a pivotal shift, accelerating institutional adoption despite El Salvador's brief 2021-2025 experiment with Bitcoin as legal tender.

Strategy now leads corporate holdings with 607,770 BTC ($71B), while Bitcoin Treasuries data reveals 3.6 million BTC distributed across 281 entities. This institutional wave transforms Bitcoin from speculative asset to cornerstone of a tokenized financial system—one increasingly resistant to inflation and geopolitical shocks.

Japanese AI Firm Quantum Solutions to Acquire 3,000 Bitcoin as Treasury Reserve

Quantum Solutions, a Japanese AI company, announced plans to invest in Bitcoin through its Hong Kong subsidiary, GPT Pals Studio. The firm aims to purchase up to 3,000 BTC over the next year, valued at approximately $354 million, starting with an initial $10 million leveraged buy. This strategic shift marks GPT's first foray into digital assets, driven by concerns over fiat currency depreciation and global financial instability.

The company will manage its Bitcoin treasury through a dedicated account at Hashkey Exchange, implementing a phased investment approach. "Diversifying into Bitcoin strengthens our financial resilience against forex risks while preserving long-term value," the firm stated. Japan's corporate Bitcoin adoption continues gaining momentum, with Metaplanet currently holding 16,352 BTC—a trend reflecting growing institutional confidence in cryptocurrency as a hedge against rising bond yields.

Bitwise CIO Declares Traditional Crypto Cycle Dead as Institutional Drivers Take Over

Matt Hougan, Bitwise's Chief Investment Officer, has pronounced the demise of cryptocurrency's four-year boom-bust cycle. Institutional capital and regulatory maturation now dominate market dynamics, rendering historical patterns obsolete.

"The forces that created prior cycles are weakening," Hougan asserted, citing three structural shifts: Bitcoin halvings' diminishing impact, favorable interest rate trajectories, and reduced systemic risk from institutional participation. ETF adoption represents a multi-year trend barely begun, with national platform approvals still pending.

2026 will likely shatter cyclical expectations through record institutional inflows. The market's transformation mirrors gold's evolution from speculative asset to institutional staple - but occurring at blockchain speed.

Bitcoin Gains Traction in Reserve Discussions as De-Dollarization Accelerates

BlackRock's July 2025 report confirms de-dollarization is now a measurable trend, with central banks diversifying reserves amid geopolitical tensions and U.S. debt concerns. Gold purchases approach 50-year highs, while Bitcoin enters sovereign-level conversations for the first time.

Strategic Bitcoin reserves are being established by governments including the U.S., Pakistan, and Texas—operating outside traditional central bank frameworks. Institutional inflows and ETF growth position BTC as a potential long-term hedge, though gold remains the dominant safe-haven asset.

The $12.5 trillion asset manager notes this shift stems from inflationary pressures and eroding confidence in dollar supremacy. "You make a hell of a..." remarked former President Trump during recent comments on currency strength, leaving the thought unfinished like the market's uncertainty about crypto's reserve currency potential.

Bitcoin Surges Past $1T Realized Cap Amid Institutional Demand

Bitcoin's realized capitalization crossed $1 trillion for the first time as prices stabilized above $118,000 following a $9 billion sell-off by an early adopter. The milestone reflects deepening liquidity and conviction among both long-term holders and new entrants.

Glassnode's latest data shows July delivered one of 2024's most robust rallies, with BTC briefly touching $122,700 before consolidating. The uptick triggered profit-taking from veteran investors while attracting fresh capital—a dynamic that's historically preceded sustained bull markets.

Unlike market cap calculations, realized cap tracks the actual dollar value invested in Bitcoin based on each coin's last movement. This metric's ascent past the trillion-dollar threshold signals maturation beyond speculative trading into institutional-grade asset territory.

Corporate Bitcoin Holdings Surge 46% as Public Companies Accumulate Over 1,000 BTC Each

Corporate Bitcoin adoption is accelerating at an unprecedented pace. According to Fidelity Digital Assets, 35 publicly traded companies now hold at least 1,000 BTC as of Q3 2025—a 46% increase from just 24 firms in Q1. These entities collectively control approximately 900,000 BTC, valued at $116 billion at mid-2025 prices.

The trajectory reveals a seismic shift in institutional behavior. While fewer than five companies held such positions before 2021, the number climbed steadily through 2023 before spiking dramatically this year. Q2 2025 alone saw public companies add 134,456 BTC to their balance sheets—a 35% quarterly increase from Q1’s 99,857 BTC accumulation.

Fidelity’s data shows corporate buying has become more broadly distributed, signaling deepening institutional conviction. "This isn’t just early adopters anymore," notes analyst Chris Kuiper. "We’re seeing mainstream financial players building strategic positions." The chart’s near-vertical ascent since late 2024 underscores Bitcoin’s transition from speculative asset to corporate treasury staple.

Kiyosaki Advocates Bitcoin and Gold as Hedge Against Financial Crisis

Robert Kiyosaki, author of 'Rich Dad Poor Dad,' has intensified his warnings about systemic financial risks, urging investors to abandon paper assets like ETFs in favor of physical holdings. His strategy centers on bitcoin, gold, and silver—assets he views as impervious to counterparty risk during market collapses.

'An ETF is like carrying a photo of a gun for protection,' Kiyosaki remarked, underscoring the fragility of derivative instruments. His critique targets the structural vulnerabilities of exchange-traded products, which he argues may fail during liquidity crunches or custodial defaults.

The commentary arrives amid mounting macroeconomic pressures: global debt surpassing $307 trillion, inflationary persistence, and regional bank instability. Kiyosaki's position reflects a growing institutional sentiment—bitcoin's scarcity and verifiable settlement increasingly position it as a digital analogue to precious metals in wealth preservation strategies.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC's Olivia projects:

| Year | Conservative | Base Case | Bull Case | Catalysts |

|---|---|---|---|---|

| 2025 | $150k | $210k | $300k | ETF inflows, halving aftermath |

| 2030 | $250k | $500k | $750k | Corporate treasury standard |

| 2035 | $400k | $1M | $2M | Reserve currency status |

| 2040 | $750k | $2.5M | $5M | Full institutionalization |

"These projections assume sustained 50-60% annualized growth as BTC becomes the digital gold standard," Olivia emphasizes, noting that regulatory clarity remains the key variable.